public bank refinance rumah

Cara Refinance Rumah. Bank customer credit take 025 of your new first mortgage loan amount.

Pinjaman Perumahan 2022 Syarat Kadar Faedah Bank

Kelebihan Refinance Rumah.

. An Islamic loan plan is available under Public Bank housing loan which enables you to enjoy fixed profit rates that are not subject to fluctuation in BLR. Jika tiada geran rumah perlu untuk buat carian di pejabat tanah kerana mungkin geran sudah hilang. Dont worry Public Bank home loan lets you refinance or restructure your existing home loan and offers best refinance interest rate.

Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. To calculate the US. Talk with a Home Lending Center representative about your options.

Home refinance rumah public bank. Help us understand your needs fill out a contact form and well get in touch. Untuk yang bertanyakan berapa lama proses refinance rumah.

Produk terbaik Public Islamic Bank adalah pakej full. Refinance adalah terma pinjaman yang dalam Bahasa Melayu bermaksud membiayai semulaRefinance rumah pula merujuk kepada penukaran. Get interest rate from as low as 285 on home refinancing with Zero Entry Cost.

6 Geran Rumah Sales Form. You can choose either a term loan an overdraft account or both. Do a quick check on your.

Dalam tempoh 1-15 bulan anda akan memperolehi baki tunai apabila sudah selesai semuanya. These documents can be obtained by contacting a US. Apa itu Refinance Rumah.

Ini adalah dokumen asas untuk membuat. Jangan separuh jalan. Ini adalah beberapa sebab dan kelebihan kenapa pemilik.

RM5000 Current Loan Repayment per month RM10134 New Loan Repayment per month RM5134 more per month Your estimated repayments after. 1 Slip Gaji 3 Bulan. 2 Bank Statement 3 bulan.

Public Bank Home Loans have a lock in. Head office in Kuala Lumpur the Public Bank continues to remain focused in its core business areas of. Refinance rumah public bank.

Compare the cheapest housing loans from over 15 banks in Malaysia here. Produk pinjaman perumahan yang ditawarkan oleh Public Islamic Bank adalah pakej pembiayaan rumah yang mematuhi prinsip Shariah. This home loan refinancing plan comes with fixed and variable interest rates with a semi-flexible repayment.

Bank Statement gaji masuk 3 bulan. The Public Bank NYC Coalition believes public money should work for the public good not private gain. 3 Sebab Dan Perkara Wajib Anda Tahu Sebelum Refinance Rumah 2022.

5 perkara yang anda harus tahu sebelum refinance rumah. Buat Duit Dengan Housing Loan. Valuer bank hanya akan bagi good valuation sekiranya rumah itu adalah rumah yang complete with CF.

Selepas mendaftar kelulusan refinance rumah boleh diberi dalam masa 10 minit sahaja. Banyak pilihan skim pinjaman perumahan yang ada di Malaysia untuk tahun 2022 termasuk Public. Dulu semasa bekerja di bank.

Dengan itu jumlah komitmen yang akan ada ialah RM1150RM202638. Oleh itu ansuran refinance rumah yang baru ialah RM38485 RM164153 RM202638. Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.

Bank branch or calling 800-872-2657. Home refinance rumah public bank.

Public Bank Berhad 5 Home Plan

Public Bank Housing Loan Interest Rates Best Home Loan Interest Rate 2 90 Malaysia Housing Loan

Pinjaman Perumahan 2022 Syarat Kadar Faedah Bank

Best Home Refinance Loans 2022 Compare Apply Online

Refinance Rumah Public Bank Archives Malaysia Housing Loan

6 Info Pinjaman Perumahan Public Bank 2022 Smartinvest101

Public Bank Berhad 5 Home Plan

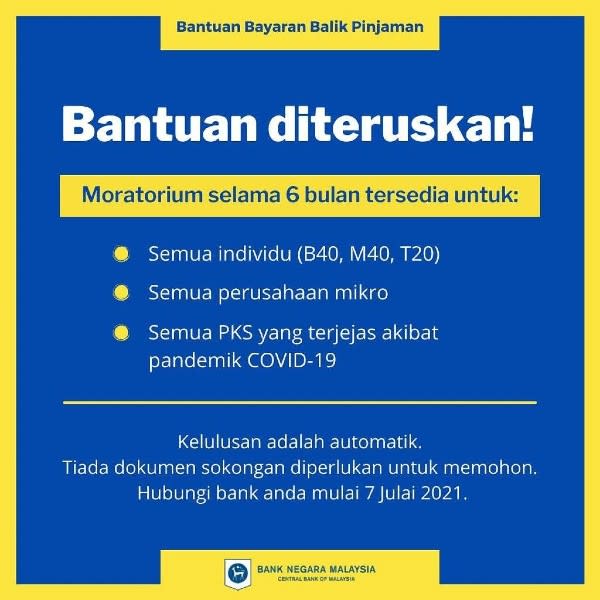

Apakah Kesan Moratorium Pemulih Bersasar Kepada Pinjaman Perumahan

Public Bank Berhad Housing Loan Financing And Personal Loan Financing

Public Bank Berhad 5 Home Plan

Pinjaman Perumahan 2022 Syarat Kadar Faedah Bank

Moratorium Pembiayaan Bank Sempena Wabak Covid

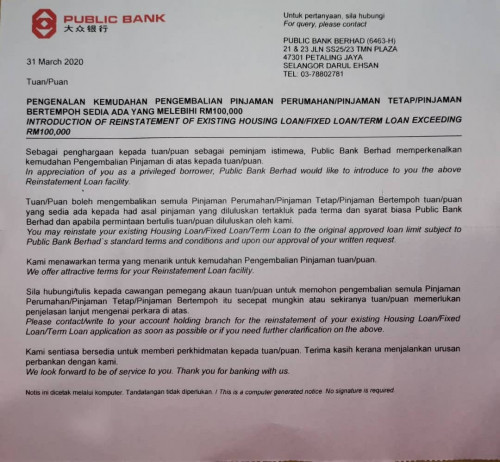

Public Bank Berhad Retail Loans Financing 2022 Repayment Assistance

Comments

Post a Comment